Trading order management is based on software and services specially designed to fulfill and manage the order execution in currency trading. The system aims at operating and control over the order flow and forwarding of the orders to other parties.

The trading order management embraces all stages of the trading process in the situation of the ever-changing market, which means order placement, execution and processing. In other words, the trading order management system ensures real-time monitoring, navigation and generation of customizable reports. In fact this system is a virtual workstation of a private trader; a trader may well make system

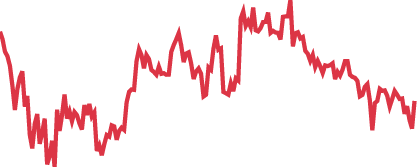

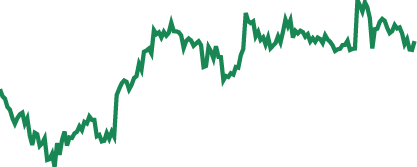

Along with this, trading order management system provides reports and analytics to help clients monitor the overall market situation and its trends. Regulatory requirements are also taken into account in trading order management. It is also notable to consider which trade and liquidity platforms are used for trading order management. In most cases this information is the key to understand whether the system is timely updated and undergoes regular upgrades for the purpose of making the workflow as smooth and fast as possible.

Help us determine the best trading order management system of today! Vote here.