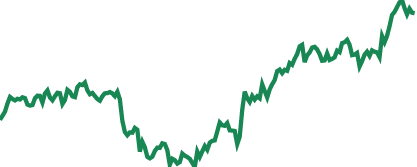

The evolution of placing orders has gone a long and impressive way, from fixed-line phones to computers, and now to diverse mobile devices. Various mobile trading platforms allow private traders to monitor the markets while they are on-the-go and away from their desktops and other all-equipped devices. Mobile trading format is not really supposed to replace the desktop platform, but it provides traders a much-needed tool to supplement the regular trading platform. For instance, opening a new position would be easier on a desktop, yet closing is something you can easily and promptly do on your mobile device.

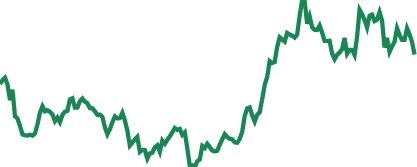

A variety of trading terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. What should be this vital decision based on? To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets.

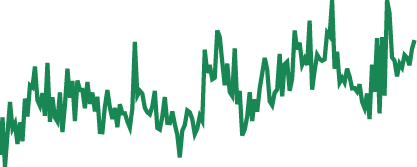

Mobile trading gives excellent opportunities to never miss a trade. Mobile platforms provide access to all the open trades, pending orders and trading history of a particular trader. A perfect mobile application has to provide quality performance of all the necessary functions. There are mobile trading platform versions designed specifically for Windows Mobile, for iOS and for Android. Using a proper mobile trading platform one is able to get the latest news and to follow the market trends; along with this, at any moment you are able to open and close trades, place orders and set stops/limits; to view full account summary and trading history.

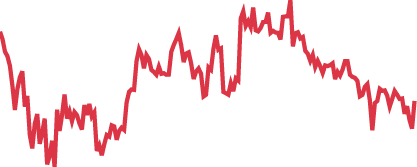

The terminal should function without technical failures, including times of increases in liquidity. Such flaws are observed mainly on web platforms. For supporters of long-term trade, such drawbacks are not significant, but for scalpers, delays in processing trade orders can lead to loss of profits. To avoid such problems, it is recommended to install trading software on a home computer, but this is not always effective.

A good mobile trading platform should have enough tools for technical-analysis. When transferring indicators to a chart, developers should have incorporated the possibility to adjust input parameters. It is equally important to use several time periods of the chart for making a trading decision. By the way, according to the method of A. Elder, this method of filtering spurious signals is a key element of the strategy. The program should be able to work simultaneously with several financial instruments, as well as with automated trading systems. A trader should not have difficulty placing urgent, safety or pending orders. An additional advantage of the terminal will be the presence of a window for monitoring trading volumes (a glass of prices) and important macroeconomic events capable of provoking a violent market reaction.

It is important to take into account that some of the platforms mentioned are copyrighted by brokers, so trading in them is possible only when opening an account with a particular company.

Choosing a proper mobile trading platform is specifically important for the day traders, as they need to keep an eye on the market uninterruptedly. With an array of mobile trading software available on the market a considered expert opinion is much in demand. Share your vision of the best mobile trading platform of today!