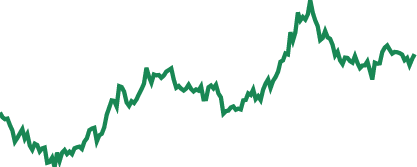

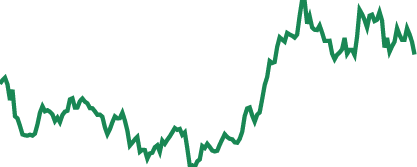

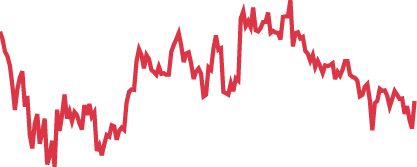

What is the key point to understand when it comes to the idea of the "Best Execution"? Trade Execution Speed/Price is the most important attribute in Forex Awards survey, according to investors polled in the survey. In fact, this means that the order of a trader is executed in a way which is most beneficial for the trader. In this sense it doesn’t make any specific difference as to which agent exactly performs this action, be that a forex broker, or a market maker, or some other business entity. Average execution speed measures a firm's ability to receive a quick and efficient execution. This statistic represents the difference between the order route time and the time of order execution. Fast execution forex brokers ensuring accurate and transparent order execution deserve special recognition, therefore we are introducing the best in class here. Fast execution implies the best liquidity price for a trader or investor. Traders’ orders have to be executed either in the interbank liquidity market or by means of matching a trade with another customer order.

FX best execution operations can be segregated into two main categories: No Dealing Desk (NDD) and Dealing Desk. Subject to a preferred type a trader gets specific spreads and specific trading conditions.

Fastest forex broker providing high-class solutions to their customers around the world are multiple, but it is in any case essential to understand differences of various service packages offered, and to select the brokerage offering the optimal execution terms, such as fast order execution speed, accuracy of order executions, precise forex signals, no slippage, no requotes, etc. To help verify the quality of trade execution, investors might need to do a bit of work. If you place a market order to buy a stock, you can expect to pay the ask price. For a market sell order, the opposite is true: You can expect to receive the bid price.

Help your fellow traders find best execution broker of today. Vote here!