2017 was undeniably the year of Bitcoin – starting off under pressure of a potential Chinese crack-down, it fell to $786. By the end of the year though it reached an astounding, record-breaking $20,000.

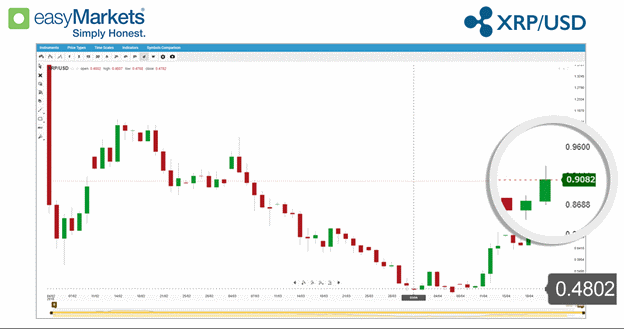

Ripple seems poised to follow in its big crypto-brothers footsteps – going from high to higher. In just twenty days XRP experienced an amazing 82.11% increase - from 0.4802 on April 1st to 0.8745 (prices indicative at the time of writing) on the 24th of April.

In fact, the rise is so significant that Forbes asked the question if Ripple is the new Bitcoin. Analysts say the reason behind the rise can be largely credited to Ripple simply having better technology behind it. It performs transactions faster than Bitcoin, it carries lower fees – making it perfect for institutional level use. Also, its main purpose as payment protocol makes it a perfect candidate to help streamline payment flows. This also gives it the potential to truly disrupt the financial industry as more institutional clients adopt it.

The biggest obstacle at the moment is that XRP isn’t offered in exchange for fiat currencies on most cryptocurrency exchanges. To purchase Ripple you need to purchase a different cryptocurrency and exchange it for its equivalent in Ripple.

This makes it slightly more technical for the laymen to speculatively invest in the cryptocurrency, but the interesting thing is that some market watchers assume that this will change soon –popular cryptocurrency exchange sites will eventually offer Ripple in exchange for fiat currencies. This may cause a surge of speculative investors, as we saw with Bitcoin in 2017. Ripple may be on the same meteoric path as Bitcoin if this happens.

At the moment Ripple is being used in over 60 Japanese financial institutions and last month a rumor circulated that South Korea Bank would start testing XRP. Last year Western Union and another South Korean Bank - Woori announced their testing of XRP. Many of these banks mention 2019 as the year they will start applying the technology to perform global financial transaction. Does this mean we will see more significant movements that year? It all depends on how the testing will go.

Of course people can also trade Ripple CFDs without the need to even actually own the asset. This negates the need for complex purchases and exchanges normally involved in owning Ripple. CFDs allow you to follow the price fluctuations and use certain tools that would not be available to you while offering support if you are new to the cryptocurrency market. This can be a good solution if you are only interested in following an upward or downward trend. This is another benefit of CFD trading – you can potentially benefit by both upwards or downwards movements as you don’t purchase or sell the actual asset.

The question still stands though – as it did with Bitcoin – is Ripple’s intrinsic value its use as a currency or is it in the underlying technology? Until these virtual currencies are made at least as user-friendly as other forms of payment and adapted by both the public and financial institutions – we will not definitively know.

OnsaFX has been honored with the "Best Forex Partners Programme" award at Wiki Finance Expo Dubai 2025, one of the world’s leading financial and fintech events.

OnsaFX has been honored with the "Best Forex Partners Programme" award at Wiki Finance Expo Dubai 2025, one of the world’s leading financial and fintech events. FxPro, the leading online broker, is excited to announce the full launch of TradingView integration across its trading platforms, following a successful beta phase.

FxPro, the leading online broker, is excited to announce the full launch of TradingView integration across its trading platforms, following a successful beta phase.