Exness General Information

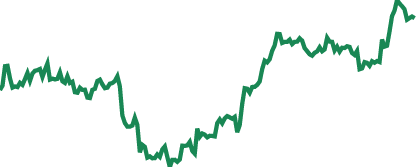

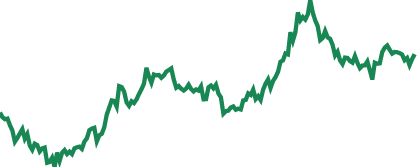

Founded in 2008, multi-asset broker Exness is an industry leader serving more than 400,000 monthly active clients from across the world. Regulated by the FSA (Seychelles), CBCS (Curacao), FSC (BVI), FSCA (South Africa), CMA (Kenya), FCA (UK), and CySEC (Cyprus), Exness entices traders by offering a wide range of account types and financial products that complement different trading strategies. In addition to its successful retail operations, the broker provides B2B solutions for international corporations.

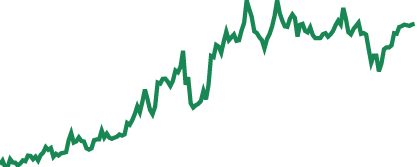

Since its establishment 15 years ago, Exness has hit multiple milestones and experienced significant growth. In February 2023, the firm reported an impressive trading volume of 3 trillion USD, breaking the company’s previous records.

To meet the demanding needs of its expanding customer base, Exness offers intuitive trading platforms to its clients including the MT4 and MT5 as well as proprietary platforms available for mobile and desktop devices such as the Exness Terminal and Exness Trade app. Catering to traders of various levels of risk tolerance, the broker offers no minimum deposit (on Standard account types) and an unlimited leverage to clients who have met specific requirements. Together with its tight spreads and vast array of trading instruments, Exness creates an ideal environment for both novice and experienced traders to enjoy trading.

Exness Pros & Cons

Pros:

- Tight spreads and low minimum deposit

- A variety of account types tailored to various trading needs

- Unlimited leverage available to MT4 and MT5 accounts

- Instant withdrawals

- Customer support available in 16 languages

Cons:

- No current bonuses

Security

With honesty and transparency being its core values, Exness is one of the first brokers to undergo and publish regular financial reports. The Cyprus-headquartered company has appointed Deloitte, a Big Four accounting firm, to verify its financial statements twice a year. An industry leader in audit and consulting services, Deloitte verifies the existence and accuracy of Exness’ trading volume, agents’ commissions, as well as its clients’ withdrawals. Traders can access the broker’s previous audit reports on the Exness website.

To safeguard clients’ assets with the company, Exness holds clients’ funds and its own operational funds in segregated accounts. On top of that, Exness’ cash reserves always remain several times larger than those of its traders, meaning that the broker is always capable of satisfying clients’ withdrawal requests. To further protect its clients’ transactions, Exness requires the provision of a verification code from the customer’s security type in order to process withdrawals.

Trading with Exness means placing your funds in the hands of a licensed and trusted broker. This means you are provided with a safe and secure trading environment.

Account Types

Exness is committed to fulfilling the needs of a wide spectrum of traders. Therefore the broker provides five different types of accounts for its clients to choose from, with each account type boasting different features tailored to specific trading needs.

Exness Standard Accounts

Suitable for beginners, Standard accounts require no minimum deposits and have a minimum spread of 0.3 pips. There are two types of Standard accounts, namely Standard Cent and Standard.

Standard Cent The Exness Standard Cent account is compatible with the MT4 trading platform. Exness customers who hold a Standard Cent account are free to trade 36 forex pairs and metals that Exness offers. The account features unlimited leverage and is not subject to any commissions.

The most unique feature of the Exness Standard Cent account is that it enables traders to open a position for 0.01 cent lot. This is perfect for novice traders who do not wish to put their funds at huge risks when they are still at the early stage of becoming a trading expert. Traders can open an order for a maximum of 200 cent lots, and they are allowed to have no more than 1,000 open market orders at a time. However, Exness does not offer any demo Standard Cent accounts so traders have to test their strategies by entering the live markets.

Standard

Exness Standard account holders can access both MT4 and MT5. The Exness Standard account offers unlimited leverage for both platforms. Same as the Standard Cent account, no trading commissions are applied to the Standard account. Other than metals and forex, Exness Standard account holders can test their trading skills with all other financial instruments available at Exness, including cryptocurrencies, energies, indices and stocks. Nevertheless, the Standard account requires a minimum volume of 0.01 lot for traders to open a position.

All in all, the Exness Standard account is ideal for beginners who are after more trading options than what the Standard Cent account provides and are willing to trade in larger increments.

Exness Professional Accounts

With extremely low spreads starting from 0.0 pips, Exness Professional accounts are designed for seasoned traders. Their minimum deposit requirements vary with countries of registration. There are three different types of accounts under the Pro category, including Pro, Raw Spread and Zero.

Pro

The Exness Pro account is the only account type that offers instant execution. Instant execution enables traders to have Exness execute an order at their requested price, making it possible for traders to enter the market at a fixed price. Since instant execution is a powerful tactic in some trading strategies, the Pro account has unsurprisingly become one of Exness’ most popular account types.

Raw Spread

As its name suggests, the Exness Raw Spread account differentiates itself from other accounts with its minimum spread of 0.0 pips. Same as the majority of Exness’ account types, Raw Spread account holders are eligible for unlimited leverage. Exness’ full collection of tradable assets is also at the disposal of traders holding a Raw Spread account.

The Exness Raw Spread account is subject to a fixed trading commission of up to 3.5 USD per lot per side. Exness customers can hold a total of as many as 100 accounts per Personal Area.

Zero

A professional traders’ favorite, the Exness Zero account allows its holders to enjoy spread-free trading for Exness’ top 30 financial instruments 95% of the day. Depending on market volatility, Exness Zero account holders can also benefit from zero spread when trading the rest of the instruments during 50% of the trading period.

The Exness Zero Spread account commission starts from 0.2 USD per lot per side and this may vary depending on the trading instrument of choice.

Exness Demo Accounts

Exness understands how important it is for novice traders to get a feel for how financial markets work before investing real money. Hence the broker introduces Exness demo accounts, a simulated market environment that enables its customers to experience real-life trading without putting their wallet at risk. With Exness demo accounts, newcomers can explore the markets and the wide range of financial products available at Exness completely stress-free. It is a great way to practice trading strategies before implementing them in live trading.

Exness demo accounts are free to open and available on both MT4 and MT5. An Exness demo account replicates the exact same trading conditions of a real trading account. After opening an Exness demo account, you will enjoy the same features available on a real account apart from deposit, withdrawal and transfer. Instead, Exness demo account holders can set their desired balance before they start ‘trading.’

Beginners are not the only ones who can benefit from Exness demo accounts. With the help of a demo account, seasoned traders can also experiment with new strategies and analyze the markets knowing that they will not be suffering from any real-world losses. Exness demo accounts are fantastic tools for both novice and experienced traders to develop their skills and grow in confidence.

Trading Instruments

To cater to every kind of trader looking to succeed in the global financial markets, Exness provides an extensive selection of trading instruments for its clients to choose from, ranging from forex, metals, cryptocurrencies, stocks, energies to indices. Traders will find financial products that catch their eyes regardless of their preferences.

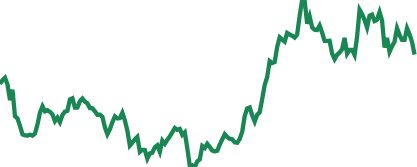

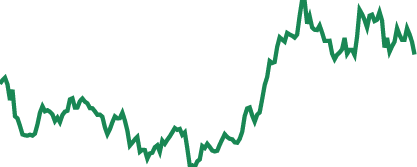

- Forex. Boasting a vast collection of more than 100 currency pairs, Exness’ forex market coverages are some of the most extensive and diverse in the industry. Exness currency pairs consist of major, minor and exotic pairs. There are a total of 7 major pairs available for trading, including AUDUSD, EURUSD and GBPUSD. Exness offers 25 minor currency pairs, which are essentially highly traded forex pairs without USD. AUDCAD, CADJPY, EURGBP and GBPAUD are a few examples. Last but not least, Exness customers are given 63 exotic currency pairs to choose from. Made up of a leading currency paired with the currency of an emerging economy, exotic pairs are not as popular as majors and minors and are therefore subject to larger spreads. Examples of exotic pairs include AUDZAR, CADNOK and DKKJPY. The variety of Exness currency pairs has made Exness an excellent forex broker. Exness is capable of keeping traders satisfied no matter what strategies they are adopting.

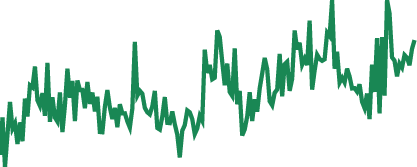

- Metals. Metals with high economic value such as gold, silver, palladium and platinum have stood the test of time and remained as some of the most traded financial instruments today. To meet its clients’ needs in metals, Exness has made 12 metal pairs available for trading, including XAGEUR, XAGGBP, XAUAUD as well as BTCXAG and BTCXAU.

- Cryptocurrencies. The popularity of cryptocurrencies is undeniable. Therefore Exness has made sure the demand is met by featuring 34 cryptocurrency pairs in its range of tradable assets. Other than Bitcoin, which has taken the world by storm, Exness customers are given the options to trade bitcoin cash, Ethereum, Litecoin and Ripple.

- Energies. Thanks to their high volatility, energies draw the attention of many traders and are often used to diversify one’s trading portfolio. At Exness, traders can choose between UKOIL, USOIL as well as XNGUSD.

- Stocks. There are over 90 stocks featured amongst Exness’ portfolio of financial products. Trading with Exness means you will have access to active stocks such as Apple, Amazon, Netflix, Pfizer and Tesla.

- Indices. Indices are relatively easier to analyze compared to other instruments. This explains why they remain a favorite amongst traders and investors. Exness customers can access 12 different indices, such as Hang Seng Index, Financial Times Stock Exchange 100 Index and Dow Jones Industrial Average.

Exness Trading Tools

To deliver an effortless trading experience, Exness provides its customers with one-stop powerful tools to help them make well-informed trading decisions. Traders who have chosen Exness are equipped with tools for both fundamental and technical analysis, comprehensive research tools and more.

- Exness Trader’s Calculator. The Exness Trader’s Calculator is a must-have for all traders. It calculates all the basics of a trader’s trading positions, including pip value, swap and margin. Compatible with all instruments across all account types, the Exness calculator is particularly useful when traders open multiple orders involving different financial products.

- Exness Economic Calendar. Straightforward and easy to use, the Exness Economic Calendar is an indispensable tool for fundamental analysis. The tool allows traders to observe multiple currencies, stocks and the upcoming news that may impact their prices. In the case of influential news and events that will lead to higher margin requirements, Exness will alert traders with a notification on their trading terminal, which will appear under the “Mailbox” tab.

- Currency Converter. Traders looking for quick currency conversions will find the Currency Converter handy. The user-friendly tool enables users to simultaneously view the conversion rates of six chosen currencies. The Currency Converter is updated in real-time so traders are guaranteed to obtain the latest conversion rate. A version of the Currency Converter is available on the homepage of Exness’ website. It enables traders to view the conversion rates of six currencies at a time.

- Trading Central WebTV. Trading Central WebTV is one of the most powerful tools that Exness is offering. Powered by Trading Central, an industry leader in financial investment research, Trading Central WebTV is a video stream of financial news broadcasted live from the New York Stock Exchange. Available in a few different languages including English, Simplified Chinese, and Arabic, the tool assists Exness clients in analyzing the markets with the most up-to-date information.

- Exness VPS Hosting. Exness looks after the needs of clients looking to have their trailing stops constantly functioning by offering them a free VPS. Traders can apply for an Exness VPS for free as long as they meet certain requirements - these can be found on the broker’s dedicated Help Center. With the help of an Exness VPS, traders can connect to and use a remote terminal, the server of which is in the immediate vicinity of Exness’ main trading servers, as if they are trading right from their PCs. Aside from making it possible for trailing stops to function uninterruptedly, the Exness VPS provides traders with a robust connection whilst using scripts and Experts Advisors during trading.

Registration at Exness

Exness has kept its registration process easy and straightforward to create a fuss-free trading experience.

Opening an Account

The fastest way to open an account at Exness is to complete the ‘New Account’ form on the right sidebar of the Exness website. After selecting their country of residence, providing an email address and choosing a password, traders will be offered the options to open a demo or real trading account.

Alternatively, traders can open an Exness account by clicking the “Open account”’ button on the homepage of exness.com. They will be redirected to the general registration page, where they are asked to submit their country of residence, email address and create a password.

Exness customers can also register for a trading account from the account types descriptions under the “Accounts & Instruments” tab on Exness’ website. There, they can select to view the specifications of the Standard or Pro account as well as choose whether they want to open an MT4 or MT5 account by clicking the respective button. After that, traders can complete the registration by filling in the requested information on the general registration page.

KYC Verifications

To prevent identity theft, financial fraud, money laundering and terrorist financing, Exness has set up a simple KYC process to verify the identity of its new clients. The broker’s new customers are required to provide proof of identity, residence and complete their economic profile. Exness’ simple but stringent KYC verification process has protected its trading environment without becoming an obstacle for its clients.

Deposits and Withdrawals

Exness provides a great variety of payment options to make sure all deposits and withdrawals made are as seamless as possible. It’s worth noting that Exness doesn’t charge any fees for deposits or withdrawals though there may be charges from the payment provider of choice. Also, the majority of withdrawals are processed automatically, without manual checks, which results in clients receiving their funds almost instantly - barring any delays from the payment provider they have chosen for their transaction.

Exness Minimum Deposit and Withdrawals

As mentioned earlier, the minimum deposit for Exness varies based on account type. Exness’ minimum deposit for Standard accounts is as little as USD 10, whilst Professional accounts require a minimum deposit starting from USD 200. As for Exness’ minimum withdrawal limits, these change depending on the chosen withdrawal method.

Electronic Payment Systems

There are several electronic payment systems (EPS) available at Exness, including Skrill, Perfect Money, Neteller, WebMoney, and Sticpay. They allow instant deposits and withdrawals, meaning that transactions can take place in a few seconds without manual processing. Some EPS do charge a commission fee when making deposits or withdrawals. The use of EPS may also be restricted depending on the country traders are located in.

- Cryptocurrencies. At Exness, cryptocurrencies are not only trading instruments but also payment options. Exness accepts Bitcoin, Tether and USD Coin for deposits and withdrawals. Traders who choose Bitcoin as a payment method are instructed to create an Exness Bitcoin wallet, where all payments in Bitcoin take place. The Exness Bitcoin wallet is used for deposits, withdrawals, and internal transfers to the clients’ Exness trading accounts.

- Internal Transfers. To give traders additional flexibility, Exness allows its clients to make internal transfers between their trading accounts within their Personal Area. This makes it a lot easier for traders to distribute and manage their funds at Exness.

- Local Payment Systems. Catering to its global clients, Exness provides an assortment of local payment systems targeting different countries in various regions including Asia, Latin America, MENA and Sub-Saharan Africa. This enables traders to deposit and withdraw in their local currency, allowing them to enjoy a user-friendly, personalized trading experience.

- Bank Card. Despite the rise of EPS and cryptocurrencies, bank cards remain as one of the world’s most popular payment methods. At Exness, traders can deposit and withdraw using their physical or electronic debit or credit cards - namely Visa, Visa Electron, Master Card, Maestro Master, and JCB (Japan Credit Bureau). Bank cards support instant deposits and deliver secure payments. Nevertheless, Exness does not accept credit or debit cards issued by American banks and requires full document verification upon any bank card usage. Instant withdrawals are also not possible through bank cards. As a result, they may not be suitable for traders looking to get their hands on their funds immediately.

Exness Bonuses and Promotions

At the time of writing, Exness’ bonus programmes are no longer open for registration and the broker has no plans to reopen them. Nevertheless, Exness’ trading bonus and deposit bonus programmes are still available to clients who joined before the registration closed.

General Information

- Offices. Exness has a number of offices operating across the globe. The Exness Group has its headquarters in Limassol, Cyprus, alongside offices in Kenya, Cyprus, United Kingdom, Seychelles, British Virgin Islands and South Africa. Note, however, that the broker’s offices in Cyprus and the UK do not provide trading services to retail clients.

- Contacts. Exness Official Websites: www.exness.com. Exness Email Addresses: support@exness.com. Exness Live Chat Support: Exness’ live support can be accessed via www.exness.com. Exness Call Centre: +357 25 030 959 (Cyprus)

FAQ

- Is Exness a good forex broker? With an impressive collection of 107 forex pairs, Exness’ forex coverage is amongst the best in the financial industry. Its tight spreads, intuitive trading platforms and comprehensive analytic tools make Exness a great place for CFD trading. The broker holds its clients’ funds in segregated accounts, offering a high standard of customer protection. Overall, Exness is a reliable multi-asset broker that provides a desirable trading environment.

- Is Exness regulated? Exness’ retail operations are regulated by the FSA (Seychelles), CBCS (Curacao), FSC (BVI), FSCA (South Africa), CMA (Kenya). Exness’ B2B offerings are regulated by Cypriot and British regulators, which are CySEC and FCA respectively.

- How can I open an Exness demo account? Create and log into your Personal Area on the Exness website. Select ‘Demo’ under ‘My Accounts.’ Click ‘Open New Account’ to view the list of account types that offer the demo option. Select ‘Try Demo’ under the account type of your choice. You will then be directed to a page where you are asked to choose your trading platform, account currency, account nickname and password. You will also be able to adjust your leverage and starting balance. Finally, click ‘Create an Account’ to finish setting up your demo account.

- What is Exness’ minimum deposit? Exness’ Standard accounts have no minimum deposit requirements, whilst its Pro accounts require traders to deposit at least USD 200 to USD 3,000 depending on their country of registration. Other than account types, payment methods available at Exness usually subject their users to a minimum deposit of USD 10.

- How many days does a withdrawal take at Exness? Exness clients can enjoy instant withdrawals through EPS. Traders who opt to withdraw using cryptocurrencies have to wait up to 72 hours before receiving their withdrawals. As for withdrawals via bank cards, it takes up to three to five business days to process.