CommSec General Information

CommSec is Australia's leading online broker. With 20 years of industry leading service and experience, offering Australia's best online and mobile trading solutions CommSec is the first choice when considering retail online trading partners. See the value in moving to CommSec and discover why more Australians trade online with CommSec. Get access to cutting-edge research, such as Goldman Sachs stock recommendations and Morningstar premium ratings. Monitor the latest market movements with advanced tools like CommSecIRESS. Enjoy flexibility with your trading with features like trading limits, and take advantage of our great range of products to help develop your trading strategies and diversify your portfolio.

- Help me understand the share market. Understanding how it all works is the first step to investing in shares.

- Choose an online share broker. See why CommSec is the first choice in online brokers.

- Why make the switch to CommSec. See the value in moving to CommSec.

- CommSec One. The active trader program that gives personalised support, priority access and exclusive offers.

Powerful Trading Tools

Make informed investment decisions with comprehensive market research, free live pricing and powerful trading tools including alerts2, conditional orders, stock screeners and comparison charts.

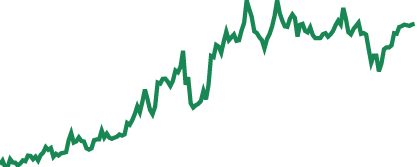

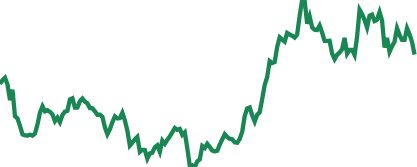

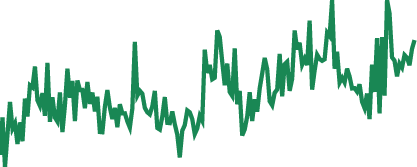

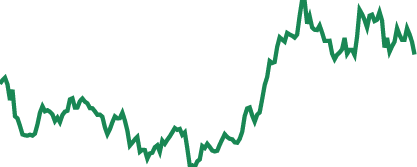

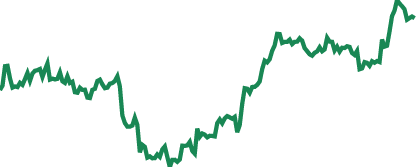

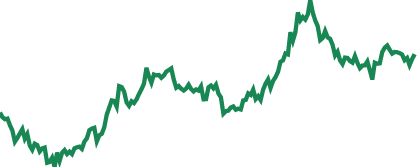

- Advanced Charting. Use CommSec’s sophisticated charting tools to compare stocks and monitor their performance.

- Create personalised watchlists. View live pricing, research and market data points for any stocks you're interested in by setting up custom watchlists.

- CommSecIRESS Viewpoint. Use CommSecIRESS Viewpoint for real-time data streaming via any web browser. It’s highly customisable, with an intuitive interface that lets you create your desktop to fit your trading style and features an extensive suite of trading tools. Its cutting edge range of features include fast and easy order placement, historical data, market map, alerts2 and watchlists. You can use CommSecIRESS Viewpoint for free when you place 8+ trades per calendar month or spend $220+ in brokerage3 or are a CommSec One client4, saving you up to $82.50 per month. Click here to find out more about CommSec One.

- Trade on the go. With the CommSec App, you can stay on top of the market and trade, whenever you like, wherever you are.

Available on the App Store or Google Play

International Shares. Trade on global share markets

With CommSec, it’s easy to invest globally. A CommSec International Securities Trading Account gives you access to global share markets, including the New York Stock Exchange and the London Stock Exchange. While the Australian share market offers some excellent investment opportunities, it makes up less than 2% of the world’s total by market capitalisation. So if you’re only investing in Australian shares, there’s still a whole world of investment potential you could be tapping into.

How it works

CommSec has a partnership with Pershing LLC, a subsidiary of the Bank of New York Mellon, that provides you access to trade on US and non-US markets (including access to Exchange-Traded Funds – ETFs) through CommSec. Once you've opened a CommSec International Trading Account, placing a trade is simple:

- Login to your CommSec Account

- Transfer the funds into the relevant currency online or over the phone by contacting the International Trading Desk

- Launch the international Trading platform to place a trade on US markets

- Contact the International Trading Desk to place a trade on Non-US markets

- View your trades and holdings online on your International Trading Account

Benefits

- Access exchanges worldwide. Through CommSec, you can gain access to major international stock exchanges, such as the New York Stock Exchange, NASDAQ, the London Stock Exchange and the Tokyo Stock Exchange.

- Diversification. Diversification is a key element of any successful investment strategy. With international trading, you can invest in markets worldwide, accessing sectors that may not be available in Australia.

- Access to well-known brands. International trading allows you to invest in businesses and brands you know, such as Google, Microsoft, Apple and many others.1

- Quotes and research for US markets. CommSec International Trading gives you access to market news, sector analysis, stock news and indices information for US markets, plus international watchlist and portfolio capability.

Risks

- Currency risk. As international securities are denominated in a currency other than Australian dollars, the value of your investment may be affected by changes in currency exchange rates.

- Political and regulatory risk. International shares are held by an international custodian, and are subject to risks relating to political, economic and regulatory changes in the country of the custodian or stock exchange.

- Taxation risk. Taxation implications can be different from investing in Australian securities and may vary depending on your individual circumstances. You will be asked to complete a US Tax form as part of the application process. This form is valid for 3 years (unless there is a change in circumstances) and means that if you qualify for Australian treaty benefits, you will be charged 15% tax on dividend proceeds. If you do not have a valid form, you will be charged 30% on sale proceeds and dividends.